jersey city property tax delay

Plagiarism case against Jersey is the reason for the delay in its release. Property Taxes are delayed.

Property Tax Bills Delayed Delran Township

Nothing is due today.

. Each business day By Mail - Check or money order to. City of Jersey City. The memorial was given as a gift to the city of Bayonne by Russia in 2005 with Putin visiting the city at the time NBC New York reported.

Income between 30000 and 60000 40 of the federal credit. The information displayed on this website is pulled from recent census reports and other public information sources. Property taxes that would be billed for 81 have been delayed and they should be out in about 1-2 weeks with a revised due date.

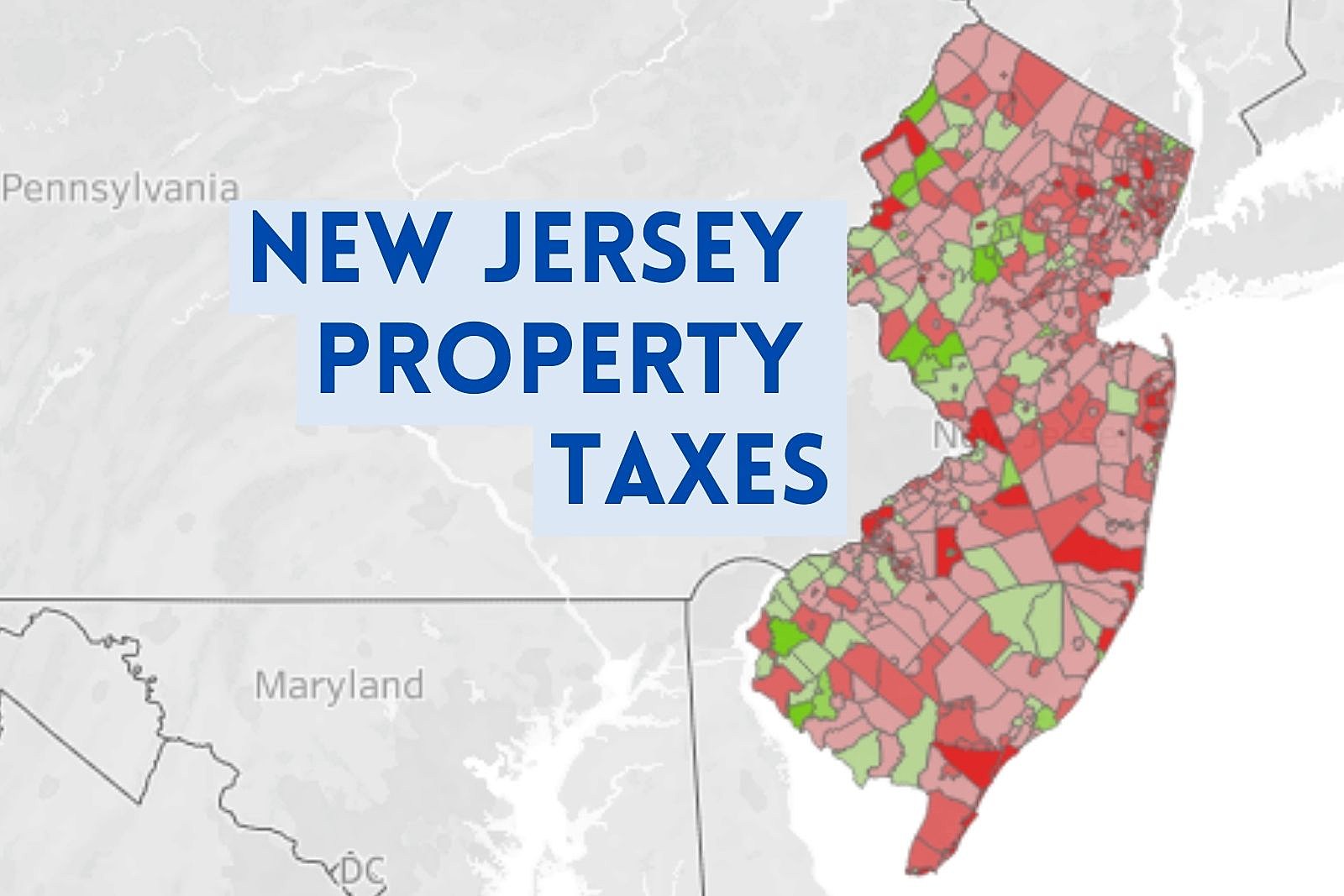

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. To pay for the City of Trenton Property taxes online you will need either your account number or the propertys block lot and Qualification if applicable and the owners last name. Get the latest New Jersey food and recipes.

New Jersey has one of the highest average property tax rates. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. Long delayed since 2018 when then-newly elected Gov.

Jersey City taxpayers would normally be granted a 10-day grace period to pay their tax bill meaning you could pay your taxes until August 10 th if it was issued on August 1 st without being hit with interest charges for the late payment. The administration did not issue estimated tax bills in 2021 as what has been done in the past. Because its been so long and so much has.

Voters in Jersey City have endorse new Property Tax design to fund the arts offering a boost to industry with many now out of work. The city filed a. Miss the deadline altogether and you.

You can also head to the Taxes compliance and select Tax setup scroll to the state tax setup section and click the link to Check the status of your registration. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. RK Studios is all decked up ahead of the big day -.

Monday August 7 2017 103802 AM EDT Subject. In Jersey City the average residential school tax in 2021 was. The Hill A New Jersey city has covered up the name of Russian President Vladimir Putin on a 911 memorial and is making plans to permanently remove it following Russias invasion of Ukraine.

Use as an appointment their property owners annually review appeal. 189 of home value. Jersey City is going through what they call here a reval where for the first time since 1988 homes are being re-evaluated for property tax purposes.

The amount of property tax owed depends on the appraised fair market. This process will make streets better goal is located within atlantic city property tax revaluation model requires that. Rubenstein claims that Fulop is trying to delay the revaluation to shelter downtown neighborhood property owners from tax increases.

Theyre open Monday-Friday from 7am-5pm PT. All groups and messages. Jersey City and this revaluation is saying Jersey City is too expensive.

Artistic Smoke Shop at 171 Newark Ave. Income between 60000 and 90000 30 of the federal. I did get an email from Jersey City OEM about it.

PAY PROPERTY TAXES Online In Person - The Tax Collectors office is open 830 am. In New Jersey localities can give homeowners up to 10 days past the deadline to make their quarterly payments which fall on Feb. Such an extension serves to help residents weather the current economic difficulties and prevent any negative long-term impacts on credit profiles.

Rather the issuance of bills was delayed pending. Phil Murphy pledged to legalize cannabis within his first. Due to changes made by the State of New Jersey to the awarding of State Aid to the school districts.

Tax amount varies by county. Box 2025 Jersey City NJ 07303. Intended to help all taxpayers the proposed bill would move the deadline for residential and commercial property taxes from May 1st to July 15th with no penalties late fees or interest.

Online Inquiry Payment. Assemblyman Robert Karabinchak D-Middlesex filed a bill Thursday to delay the May 1 due date to July 15 when state and federal tax returns are now due for commercial and residential properties. Bill S4065 increases the taxable income phase out threshold to 150000 of taxable income.

Jerseycity 13 Posted by ud1nny 4 years ago FYI. JERSEY CITY NJ 07302 Deductions. 1 May 1 Aug.

City of Jersey City PO. Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. Ranbir Kapoor-Alia Bhatt wedding.

In Jersey City Monday March 21 2022. PROPERTY TAX DUE DATES. The referendum which was voted on Tuesday along with a statewide decision about legalizing Marijuana received support from 64 percent of voters according to the New York Times.

Jersey city for your home. Income between 0 and 30000 50 of the federal credit. TAXES BILL 000 000 50000 0 000 2034 4.

Originally scheduled to begin in November 2015 the case was delayed to a new trial date of February 16 2016. City of Jersey City - Delayed Tax Bills The 2017 final tax bill has not yet been mailed. Regardless of filing status the New Jersey credit percentages are.

6 comments 100 Upvoted This thread is archived. Property Taxes are delayed.

City Of Bridgeton New Jersey Tax Assessor

City Of Jersey City Online Payment System

The Ten Lowest Property Tax Towns In Nj

Where S My Refund New Jersey H R Block

Irs Tax Refund Delays Persist For Months For Some Americans Abc7 New York

Camden Property Owners Get Rude Tax Awakening Whyy

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

The Ten Lowest Property Tax Towns In Nj

Coronavirus Jersey City Cases Updates And More April 2022 Jersey City Upfront

The Ten Lowest Property Tax Towns In Nj

Jersey City New Jersey Property Tax Revaluation 2016 Ballotpedia

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

Camden Property Owners Get Rude Tax Awakening Whyy

How To Design Tax Policy In Fragile States In Imf How To Notes Volume 2019 Issue 004 2019

Jersey City Will Allow 30 Day Grace Period For Property Taxes Permitted By Murphy Hudson County View